How Much House Can I Afford in Tulsa? A Step by Step Breakdown

Tulsa is known for its affordability, strong housing options, and welcoming lifestyle. Whether you are a first-time buyer, a relocating family, or a medical or business professional moving for work, understanding how much house you can afford is the first and most empowering step.

This breakdown gives you clear, simple guidance based on trusted national sources, Tulsa specific data, and lending standards used by major mortgage companies.

Step 1: Understand Your Income to Housing Ratio

Most lenders follow guidelines from the Consumer Financial Protection Bureau and Fannie Mae when calculating affordability.

The general rule is:

Your monthly housing payment should stay at or below 28 percent of your gross monthly income.

This payment includes:

Mortgage principal

Mortgage interest

Property taxes

Homeowners insurance

HOA fees if applicable

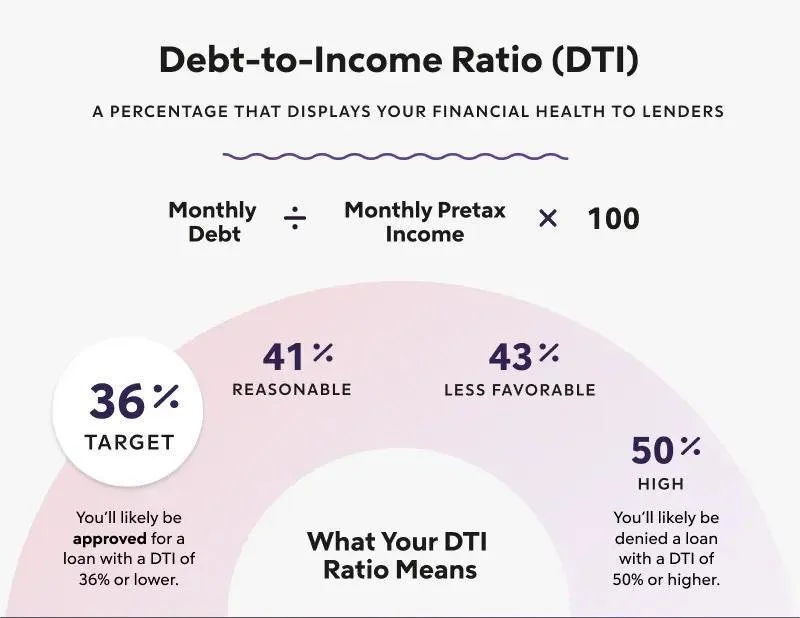

Step 2: Know Your Total Debt to Income Ratio (DTI)

Lenders also review your total DTI, which includes car payments, student loans, credit cards, and other debts.

According to Fannie Mae and Freddie Mac guidelines, the ideal total DTI is 36 percent or less, but many Tulsa buyers qualify up to 45 percent or 50 percent depending on strong credit.

High earning professionals such as physicians, engineers, and executives may qualify under expanded DTI programs.

Step 3: Understand Tulsa’s Average Home Prices

Tulsa’s housing market continues to grow steadily, supported by strong job sectors, expanding healthcare systems, and continued relocation from larger metros. According to data from Realtor.com and Zillow, Tulsa remains one of the most stable and affordable markets in the region. Buyers benefit from predictable pricing, diverse architectural styles, and a mix of historic, suburban, and new construction options.

In addition to median prices, factors such as school districts, commute routes, and proximity to commercial hubs influence local values. South Tulsa and Midtown tend to appreciate faster due to demand and central access, while Jenks, Bixby, and Broken Arrow continue expanding with new build communities and master planned developments.

According to current market data from Realtor.com Realtor.com Tulsa and Zillow Zillow Tulsa, the Tulsa Metro median home price typically ranges from $210,000 to $300,000, with the current Tulsa average home sales price at approximately $365,000, depending on the neighborhood.

Breakdown:

South Tulsa: $350,000 to $900,000+

Jenks: $325,000 to $750,000+

Bixby: $300,000 to $700,000+

Broken Arrow: $260,000 to $550,000+

Midtown Tulsa: $275,000 to $800,000+

Tulsa remains significantly more affordable than national averages according to BestPlaces BestPlaces Tulsa.

Step 4: Estimate Your Down Payment

Your down payment determines not only your monthly mortgage cost but also your ability to avoid private mortgage insurance (PMI). Tulsa’s affordability gives buyers more flexibility, allowing many to put more down than they would in cities with higher price points.

Local lenders often offer specialized programs for first time buyers, medical professionals, veterans, and relocating families. Understanding how your down payment affects interest rates, loan terms, and closing costs helps you plan with confidence. Down payments vary depending on the loan program:

FHA Loan: 3.5 percent down

Conventional Loan: 3 to 20 percent down

VA Loan: 0 percent down (for qualified military)

Physician Loans: 0 to 5 percent down, depending on lender

Helpful resource: HUD HUD Website

Tulsa buyers appreciate the flexibility because the market offers both affordable homes and luxury properties.

Step 5: Understand Interest Rates and Their Impact

Mortgage rates change daily. You can track current averages through:

Bankrate Bankrate Today’s Rates

Mortgage News Daily MND Rates

Freddie Mac PMMS PMMS

Interest rates significantly affect what you can afford. A one percent rate change can alter your mortgage approval by tens of thousands of dollars.

Step 6: Calculate Your Estimated Monthly Payment

Use these trusted calculators:

NerdWallet Mortgage Calculator NerdWallet Calculator

Bankrate Calculator Bankrate Calculator

Zillow Mortgage Calculator Zillow Mortgage Calculator

Include:

Loan amount

Interest rate

Property taxes (Tulsa average sourced from Tulsa County Assessor

Insurance

HOA fees

Step 7: Consider Additional Monthly Homeownership Costs

Beyond your mortgage, you will want to account for recurring expenses tied to Tulsa’s climate, neighborhood amenities, and typical home maintenance needs. Homes with large yards, pools, mature trees, or acreage may have higher monthly upkeep.

Utility costs in Oklahoma can fluctuate seasonally, especially during summer months. Internet providers, trash service, and water utilities vary by city and neighborhood. Understanding these expenses early helps you build a realistic monthly budget. Tulsa buyers often overlook:

Utilities (check PSO Oklahoma PSO Oklahoma

Internet (providers like Cox Internet Cox Internet

Maintenance costs

Landscaping

Pest control

These can add $200 to $500 monthly depending on home size.

Step 8: Review Tulsa Property Taxes

Tulsa property taxes remain favorable compared to national averages.

Sources:

Property taxes vary by city, school district, and home value. Tulsa metro buyers generally pay between 0.87 percent and 1.2 percent of assessed value.

Step 9: Identify Your Ideal Budget Range

Your ideal range should balance affordability with lifestyle priorities. Consider how long you plan to stay in the home, your career trajectory, future family plans, and anticipated income growth. Buyers relocating for healthcare, engineering, energy, or corporate roles often have clear timelines and may benefit from purchasing slightly below their maximum approval to maintain financial flexibility.

Tulsa’s affordability means buyers can often afford more space, newer features, or premium locations without overextending themselves. A simple way to estimate your comfortable Tulsa budget:

Income x 2.5 to 3.5 = Approximate Home Price Range

Example:

Income: $120,000

Estimated affordable home price: $300,000 to $420,000

This aligns with general affordability calculators, which place a $120,000 salary near a $580,000 property loan when other debts are minimal and credit is strong.

Check lender guidelines through CFPB or use the FHA Affordability Estimator FHA Tool.

Step 10: Get Pre Qualified With a Tulsa Lender

Image Suggestion: Homebuyer signing pre qualification documents. Alt text: "Getting pre qualified for a mortgage in Tulsa." Pre qualification gives you clarity and confidence. It also strengthens your offer when you find a home.

Some statewide lending resources include:

FlatBranch Home Loans FlatBranch Home Loans

Home Team Lending Home Team Lending

Waterstone Mortgage Waterstone Mortgage

Your lender will help determine exact numbers for:

Maximum mortgage amount

Required down payment

Monthly payment based on interest rate

Loan programs you qualify for

FAQs

What salary do I need to buy a home in Tulsa?

Most buyers earning $70,000 to $120,000 can afford homes between $250,000 and $450,000, depending on debts and credit.

Is Tulsa affordable compared to other cities?

Yes. Tulsa consistently ranks as more affordable than the national average according to BestPlaces.

Do physicians or medical professionals get special loan programs?

Yes. Many lenders offer physician loan programs with little to no down payment.

How accurate are online mortgage calculators?

They provide strong estimates but your lender will give exact numbers.

Final Thoughts

Tulsa offers a wide range of homes at price points that make homeownership possible for many families, professionals, and relocating buyers. With clear budgeting and strong local guidance, you can confidently discover what fits your lifestyle and financial goals.

Ready to Explore Tulsa Real Estate?

I would love to guide you through your next steps.

👉 Call, text, or email to schedule your Tulsa Home Affordability Consultation.

Explore more resources at: Living in Tulsa Real Estate